Satoshi’s Vision: From Paper to Practice

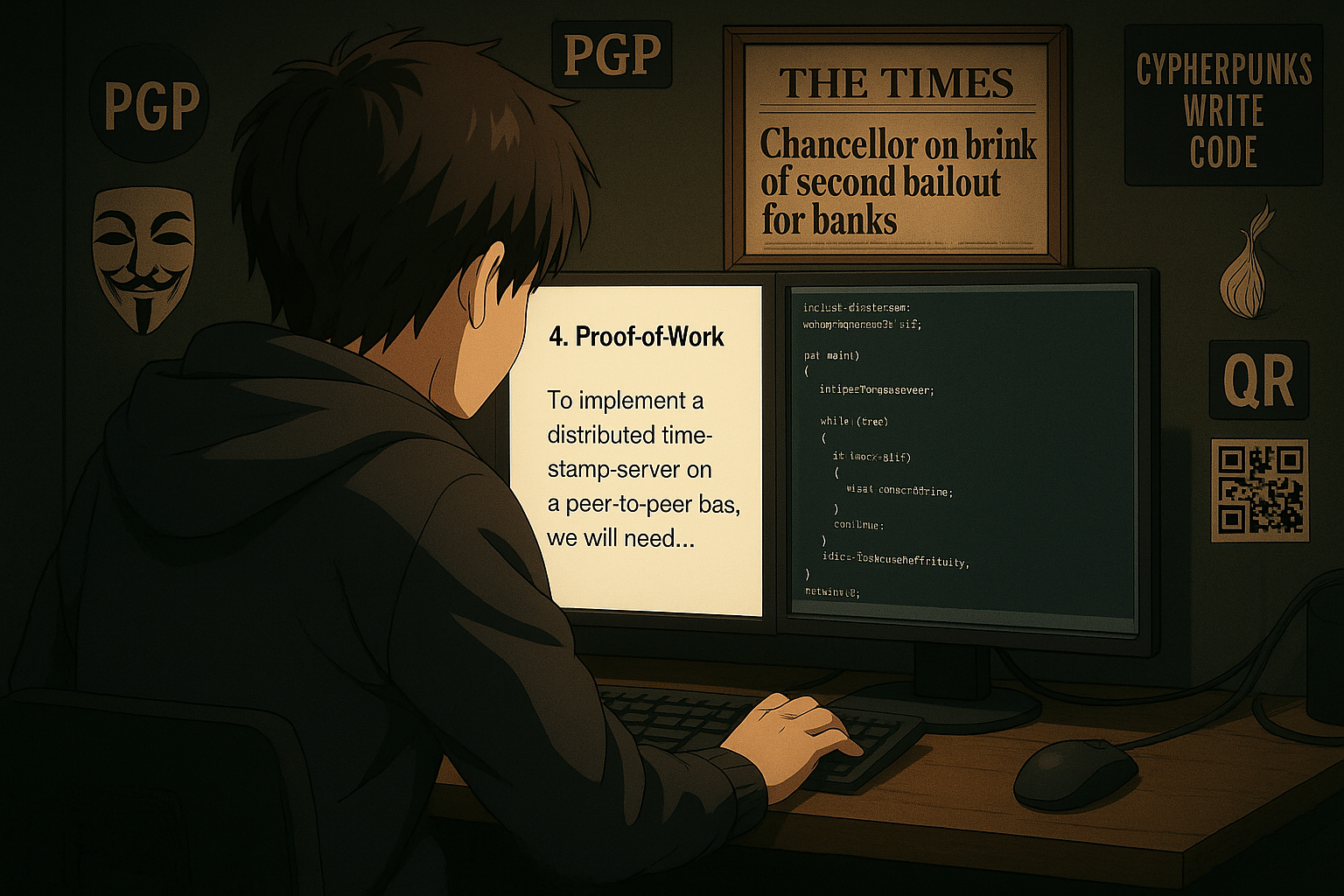

Is Bitcoin digital gold, a P2P cash system, or both? Satoshi’s 2008 whitepaper reveals a vision to bypass financial gatekeepers with true decentralization.

Is bitcoin the rebellious dream of a decentralized future or just digital gold hoarded like canned beans for the apocalypse? Is it a speculative asset, traded like stocks for quick profits, or a P2P electronic cash system for trust-less transactions? Maybe it's best used as a corporate treasury reserve for balance sheet hedging. Or as a neutral currency for immediate, intermediary-free digital settlement of international trade. Review Satoshi Nakamoto’s 2008 white paper, and you’ll find the blueprint: a permission-less, peer-to-peer electronic cash system engineered to eliminate financial gatekeepers altogether. Let’s bridge the gap between that cypherpunk ideal and the very real, global uses of Bitcoin today—plus peek at what’s coming next.

Satoshi’s Original Vision

When Satoshi Nakamoto published the Bitcoin White Paper in October 2008, the timing was no coincidence. The world was unraveling from the 2007-2008 financial crisis, banks were getting bailed out, and trust in traditional finance had tanked.

Bitcoin was proposed as:

- A peer-to-peer electronic cash system, enabling direct transactions without banks or intermediaries.

- A decentralized timestamp server, creating an immutable record of ownership.

- A trustless, borderless system, resistant to censorship and seizure.

“The root problem with conventional currency is all the trust that’s required.” — Satoshi Nakamoto

It was intended to address the flaws of centralized banking systems. Nakamoto aimed to establish a decentralized currency that prevents manipulation by governments or banks, and ensures transparent, secure transactions through blockchain technology, empowering individuals with financial sovereignty.

Bitcoin’s Real-World Use Cases

As we move further into 2025, Bitcoin has established itself far beyond its original niche. Since the 2020 global pandemic, resulting in successive waves of monetary expansion , Bitcoin has gained traction as a hedge against inflation.

In countries like Argentina, where annual inflation rates surged past 200%, Bitcoin is no longer speculative tech, it's survival money. Citizens convert pesos into Bitcoin to preserve purchasing power, using mobile wallets and P2P exchanges to stack sats. Similarly, in Lebanon, the national currency has lost over 90% of its value, leading to a surge in interest in Bitcoin as a financial lifeboat when banks froze withdrawals.

El Salvador famously became the first country to adopt Bitcoin as legal tender in 2021, integrating BTC into its national economy. However, they have since altered their policy on BTC making it optional rather than legally required tender.

Meanwhile, institutional adoption continues to grow. Bitcoin ETF's offer traditional investors Bitcoin exposure via regulated markets. However, some analysts warn about the risks of "paper Bitcoin", raising concerns about rehypothecation; where the same BTC may be counted more than once within custodial structures.

Cross-Border Remittances & Payments

Bitcoin has proven to be a game-changer in the remittance lane where legacy services charge exorbitant fees. Apps allow users around the world to send Bitcoin-backed remittances with near-zero fees, instantly settled over the Lightning Network. This is particularly impactful for migrant workers who send money back to families in developing countries.

In Africa, where mobile-first economies thrive, companies provide services that allow users without internet access to send and receive Bitcoin over basic mobile phone networks using SMS. Bitcoin vouchers are redeemable at local shops, while companies offer tools for savings, payments, and remittance via Bitcoin in nations all over the continent.

At a geopolitical level, Russia and China are using Bitcoin to settle payments for international trade. This trend is driven by increasing concerns over U.S. sanctions and SWIFT system exclusion, making Bitcoin a neutral currency for bilateral exchange.

Censorship-Resistant Fundraising

Bitcoin has become a vital tool for individuals and groups operating in environments of financial censorship. Russian journalists, for example, have used Bitcoin to receive donations and support after being cut off from state banking systems. In wartime Ukraine, Bitcoin is used in support of funding everything from medical supplies to drone equipment for defense forces. This represents one of the first large-scale examples of crypto being used in real-time for decentralized wartime logistics.

Circular Bitcoin Economies

A few communities around the world are fostering circular Bitcoin economies where it is used as everyday money. In Bitcoin Beach (El Zonte, El Salvador), locals pay for groceries, surf lessons, and even school tuition using BTC. Inspired by its success, other initiatives like Bitcoin Jungle in Costa Rica and Bitcoin Island in the Philippines are creating similar ecosystems.

These grassroots communities demonstrate Bitcoin’s utility in microeconomies. Merchants, barbers, fruit vendors, and tour guides accept Bitcoin encouraging local economic resilience while bypassing unreliable banking systems. These ecosystems are driven not by speculation but by necessity and education—a nod to Satoshi's vision of borderless, peer-to-peer money.

Future Uses

While the International Monetary Fund (IMF) remains critical of Bitcoin’s role in national balance sheets, a growing list of countries argue that BTC represents a neutral, deflationary alternative to the traditional monetary order. If adopted more broadly, Bitcoin could redefine international reserve management.

Reserve Asset

As trust in fiat currencies and global financial institutions continues to erode, several countries have begun exploring Bitcoin as a strategic reserve asset. Nations like Argentina, Iran, and the Central African Republic have been rumored to accumulate Bitcoin as a hedge against currency debasement and geopolitical instability. The U.S. established a Strategic Bitcoin Reserve to maintain government-owned Bitcoin as a national reserve asset.

Bitcoin-Backed Microcredit

Bitcoin could play a vital role in unlocking credit access through decentralized, peer-to-peer lending models. Smart contract-based technologies using Discreet Log Contracts (DLCs) aim to enable trust-minimized lending ecosystems. These systems allow users to post Bitcoin as collateral while borrowing stable-value assets in return, without relying on banks or centralized credit scores. This could significantly empower entrepreneurs and small business owners, providing them with the liquidity they need to grow and thrive.

Machine-to-Machine (M2M) Payments

Bitcoin's Lightning Network offers a new frontier in autonomous finance: machine-to-machine (M2M) microtransactions. In this model, smart devices and AI systems can pay each other directly, without human intervention. For example, self-driving cars could use Bitcoin to autonomously pay highway tolls, parking meters, or EV charging stations. Smart pallets or containers could automatically pay for warehouse storage, customs fees, or transport services as they move through global trade routes. A smart factory machine could detect a fault, hire a repair drone, and pay for the service, creating a self-sustaining ecosystem of device upkeep. These instant, programmable payments could pave the way for decentralized machine economies.

A Return to the Roots

Bitcoin hasn’t strayed. It’s growing. Whether as digital gold or digital cash, its zero-day DNA remains intact. It’s used where needed, saved where valued, and programmed for what’s next. So, what will the future of Bitcoin be? Well, that’s up to all of us.