Embracing Ubiquity: Bitcoin’s Relentless March Toward Global Adoption

Bitcoin’s global adoption is surging, the U.S. Strategic Reserve, SEC clarity, institutional investing, worldwide momentum reshaping finance.

Ok let's be real, we're talking about internet nerd money. Talking about Bitcoin, which is now stored in national reserves and bought up by financial giants for their corporate treasuries and ETFs. From cypher-punk forums to congressional memos, the decentralized experiment has gone full throttle. The U.S. government established a Strategic Bitcoin Reserve, the catalyst to a tsunami of legitimacy. Major Institutional Investors are buying it. Nations are accepting it as legal tender. U.S. States are passing Bills on it. And ordinary Americans? They’re stacking sats like never before.

But amid the headlines and hash rates, one thing remains vital: privacy. In this post, we’ll explore how the world is adopting Bitcoin and how you can join the movement while safeguarding your financial freedom.

Uncle Sam Goes Full Node

The March 2025 Executive Order was a thunderclap across global finance: the United States officially established a Strategic Bitcoin Reserve and a U.S. Digital Asset Stockpile. The reserve was initially capitalized using BTC from prior federal forfeiture proceedings. It represents the first time a major world power has formally designated Bitcoin as a strategic monetary asset.

This executive alignment signals that Bitcoin is no longer fringe, it’s federal. The BTC reserve can be considered a forward-thinking policy that leverages bitcoin's scarcity and security for long-term economic and geopolitical benefits. It could lead to increased global adoption, regulatory advancements, economic impacts based on bitcoin's performance, technological innovations, and shifts in global power dynamics.

This pioneering move sets a precedent that may inspire other nations to establish sovereign Bitcoin treasuries. It also adds a layer of macroeconomic insulation for the U.S. in an increasingly multipolar monetary world.

SEC & DOJ Drop the Hammer; Then the Wrench

Regulatory clarity has long been Bitcoin’s Achilles’ heel in the U.S., but that began to shift in early 2025 when the SEC closed investigations into major crypto exchanges and financial players, opting for no further enforcement action. The SEC then announced that certain meme-coin transactions need not register under the Securities Act of 1933, removing a cloud of legal uncertainty.

The SEC also established a Crypto Task Force to build a coherent digital asset regulatory framework. Its mission is to provide clarity on the application of federal securities laws to the crypto asset market, including digital assets, cryptocurrencies, digital coins, tokens, and protocols. This move is a break from the past “regulation by enforcement” model.

In April of 2025, the Department of Justice issued a memorandum reducing aggressive enforcement actions against digital assets. The Commodity Futures Trading Commission, Federal Deposit Insurance Corporation, and Office of the Comptroller of the Currency adopted similar approaches, permitting banks to participate in certain cryptocurrency activities without prior approval.

Together, these shifts clear the runway for institutional investors and reassure developers and users that Bitcoin isn’t flying blind in a regulatory storm.

Institutional Confidence Unleashed

Bitcoin ETFs recorded over $900M in inflows on a single day in April of 2025, and that momentum hasn’t slowed. Whale wallets (holding 100–1,000 BTC) added 122,330 BTC in just six weeks, according to data published in May of 2025. This accumulation indicates major players are betting long on Bitcoin. It seems likely that this also reflects significant institutional and high-net-worth investor activity, with 337 new wallets in this tier.

Why does this matter? Institutional buying adds price stability, encourages broader investment, and reduces volatility. As confidence grows, traditional finance becomes an on-ramp rather than a gatekeeper.

The Geopolitics of Bitcoin Adoption

Dubai broke new ground in May of 2025 by becoming the first Middle Eastern government to accept Bitcoin payments. This isn’t just symbolic, it’s a signal that crypto is viable for global commerce and government.

Other countries are also leaning in. Pakistan announced their intent to establish a government-led Strategic Bitcoin Reserve. Forward thinking Japanese firms committed to purchasing an additional ¥1 billion in Bitcoin. Moves like this have the potential to encourage more Japanese firms to invest in crypto, further underscoring institutional interest in Asia.

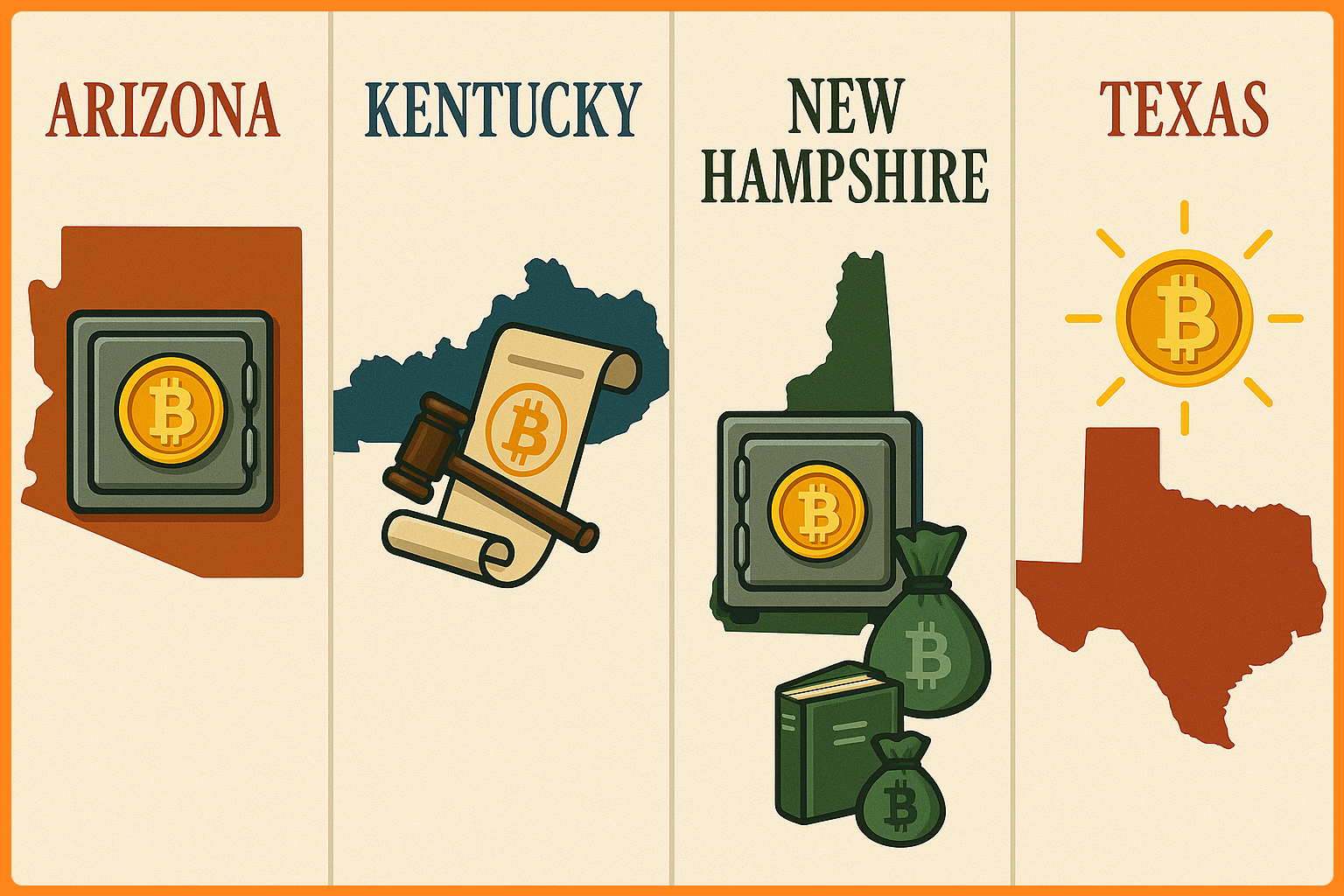

In the U.S., states are catching the bug:

- Arizona: Arizona enacted its second Bitcoin-related bill in early May 2025, following the approval of the Arizona Strategic Bitcoin Reserve Act.

- Kentucky: Kentucky became the first U.S. state to enshrine legal protections for Bitcoin users with House Bill 701, signed into law in May 2025.

- New Hampshire: On May 6, 2025, New Hampshire signed HB 302 into law, becoming the first U.S. state to create a Strategic Bitcoin Reserve.

- Oregon: Oregon's governor signed a bill in early May 2025 that updates the state's commercial code to recognize digital assets, including Bitcoin, as collateral.

- Texas: Texas has approved state-level Bitcoin reserves, with multiple bills introduced in 2025.

Geopolitically, Bitcoin is being treated less like a speculative asset and more like an infrastructural one, akin to energy or gold.

Americans Are Bullish on Bitcoin

Who "really" knows, but numbers have been floating around since the beginning of 2025 that ~28% of American adults own cryptocurrency, a figure that’s nearly doubled since 2021. Among them, ~74% hold Bitcoin, confirming its status as king of the crypto hill.

Of those planning to invest in 2025, ~66% say Bitcoin is their top target. More importantly, ~60% of Americans familiar with crypto believe Bitcoin’s price will rise during President Trump’s second term. Among current BTC holders, ~75% expect gains.

Between January 1 and May 31, 2025, publicly traded U.S. firms invested at least $4 billion in acquiring Bitcoin. The combination of institutional legitimacy and retail confidence creates a feedback loop driving broader adoption.

You Can’t Adopt Bitcoin Without Protecting Yourself

While the world turns and warms to Bitcoin, users must not forget that Bitcoin is transparent by design. Every transaction is logged on a public ledger globally accessible by anyone. Without precautions, your financial footprint is traceable.

Here are some privacy focused best practices:

- Avoid address reuse. Use a new address for each and every transaction.

- Run your own Bitcoin network node for privacy and transaction verification.

- Use wallets that can connect to the network via Tor or VPN and provide options to connect to nodes you run and own.

- Limit exposure to KYC exchanges. Consider decentralized P2P platforms.

- Cold storage is essential. Use reputable hardware wallets to keep your seed phrases offline and secure.

Bitcoin is freedom tech, but it requires effort. Take the time to learn this technology as you would any other. Utilize the vast array of resources readily available from a plethora of credible sources on the internet, in print media, ebooks, audio, etc.

Conclusion: Global, Digital, and Yours to Control

Bitcoin is no longer a curiosity. It is sound money, a hedge against fiat currency debasement, a store of value, a technological tool; it's also a protocol for permission-less global economic participation. And that's speaking in today's terms, tomorrow will be fundamentally different. Whether you’re a state treasurer or a school teacher, Bitcoin can work for you.

However, there is no substitute for taking your BTC into self custody, keeping your private-keys (read seed phrases) private & offline, protecting your personal privacy, learning and staying informed. Quantum threats are real, but so is our power to fight them. Join the mission to protect the Bitcoin network, learn about quantum-safe cryptography, run a node, or support the developers building our future!